Decoding Top Myths in the Chinese Market for Global Brands in 2023

4 September 2023 | Andy S & Shy L| 8 min read

China’s gigantic consumer market can seem irresistible for global brands, but it has myths that trip up even the most seasoned marketers. As the world’s number two economy and a shopper’s paradise, cracking the code of entering the Chinese market is crucial to succeed. In this article, we bust the biggest myths around breaking into China, connecting with Chinese customers, and giving you insider tips for global brands wanting to make their mark.

- Myth 1: The Chinese Market is a single homogeneous market

- Myth 2: E-Commerce is the Only Key to Success

- Myth 3: Overnight ROI Expectations

- Myth 4: In-Person Interviews are the Best

- Myth 5: Lost in Translation Troubles

- Myth 6 : China’s Marketing Is Behind the West

- Myth 7: Need to have a Physical Store in China

- Conclusion

Consider this article as your guide to building rock-solid China entry and growth plans by dodging rookie mistakes and truly understanding today’s Chinese consumer values and habits. Brands that do their homework on Chinese shopper demographics, regional nuances, generational differences, and marketing channels will be best positioned to unlock long-term wins in this exciting market. We will shine a light on realities that debunk those persistent myths and set you up for China’s glory!

Myth 1: The Chinese Market is a single homogeneous market

Reality: China is a large and diverse country with different consumer behaviours and preferences across regions and demographics. Such as:

City Vibes: Tier 1 vs. Tier 2/3

Tier 1 spots like Beijing and Shanghai are home to the flashy crowd craving those hot international brands. What about Tier 2 and 3 you asked? They have a rising middle class but are more down-to-earth and price-savvy.

Do not miss the opportunities of the Tier 2 & 3 cities!!!

Coastal Charm vs. Inland Insights

Coastal cities tend to be wealthier, more internationalized, and brand conscious. On the flip side, inland cities care more about keeping it real with local touches and good deals. Know who you are dealing with!

North vs. South

Southern fashionistas are more about trends and style. Northerners keep it classy and subtle.

Generations Collide: Millennials vs. the Wise Ones

Millennials are the creative crusaders, and you are all about experiences. But let’s not forget the older generations who know a thing or two about quality and good old customer service. It is like finding the balance between the flashy and the classic.

For Best Buy, entering the Chinese market was a failed experience.

Let’s break down what went wrong for Best Buy in China. This electronics giant came in hot in 2006, scooping up local retailers. But they took a one-size-fits-all approach with their big box stores that did not live long in the market.

We can break it down into three sections: counterfeits, savvy savers, and the unpopular big-box retailer format.

Counterfeits

When your stuff is made right in China, it is even easier for locals to “replicate” it. Counterfeits were a problem for Best Buy. Their American electronics were ripe for duplicating by Chinese brands once operations were in-country.

Savvy savers

Best Buy struggled to compete on price and experience with local retail titans like SUNing. Chinese shoppers found the vibe at Best Buy a turn-off – poor product knowledge from staff and no wiggle room to bargain.

And here is the kicker – the average Chinese consumer is all about a good deal. Best Buy did not properly explain why their prices were steeper. Brand awareness was not strong enough to justify the premium.

Format

On top of it all, their giant big box stores were excessive, with way higher operating costs than local retailers who rented out space. That bloated model led to pricier products that did not resonate.

The lesson? There are no cookie-cutter strategies in this market. Best Buy needed consumer research to create tailored offerings for different cities and income levels. They needed to finesse that branding to earn their price premium and adapt their retail format to match local competition. When in China, you must flex your understanding of localisation rules in the back of your mind. What works back home needs a major remix with Chinese characteristics. Do not be like Best Buy; they learned it the hard way.

Myth 2: E-Commerce is the Only Key to Success

Many brands think going digital is the only strategy you need in China. But it is not the whole story.

No doubt, China is highly advanced digitally. Mobile-first shoppers, social buying, massive e-commerce adoption – you absolutely need to be crushing it online; there is no doubt about that.

However, you should not ditch brick-and-mortar all at once. Physical stores still drive major luxury goods, makeup, and fresh food sales. Chinese consumers love a real-life shopping experience where you can stroll through the products and enjoy the moment.

For example, Amazon entered China in 2004, acquiring major local player Joyo.com. Given Amazon’s e-commerce prowess globally, they doubled down on a digital-first strategy in China.

However, Amazon struggled to gain a share against entrenched Chinese platforms like Taobao and JD.com. Reasons included:

- The limited understanding of local consumer preferences, losing out to rivals who tailored selection/user experience.

- Restrictive regulations for foreign players around digital content and payment systems.

- Lack of brick-and-mortar presence to build brand awareness and customer loyalty.

After twelve challenging years, Amazon exited China in 2016, failing to crack the market with its e-commerce focus.

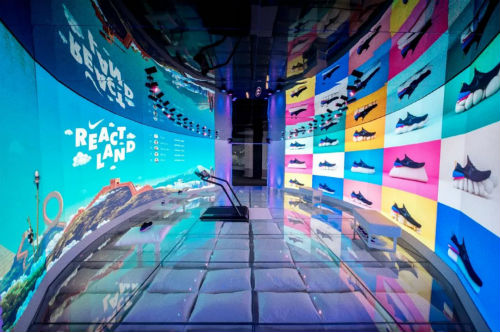

In contrast, as a global sportswear powerhouse, Nike has skillfully crafted an omnichannel approach to win over the Chinese market.

It has combined immersive offline experiences with localised e-commerce to cater to diverse consumer preferences.

Nike went big with high-tech flagship stores in all the hot spots, creating mad energy around the brand. Nike and Wieden+Kennedy Shanghai created a sweet interactive campaign letting you go wild with Nike’s new kicks.

Shoppers can jump into a giant video game and literally feel the cushy bounce of React in action.

Online, they tailored their app and site to serve up convenience, Chinese payment flows, and lightning delivery that locals love.

Nike also rallied the culture with local celebs, athletes, and designers joining their community on WeChat.

With this combo of pumped-up offline swag and dialed-in e-commerce, Nike took China by storm and secured that top spot.

Key Takeaway

The Amazon example illustrates that relying solely on an e-commerce strategy without considering local consumer preferences, regulatory landscape, and lack of brick-and-mortar presence can lead to failure. On the other hand, Nike’s success is attributed to its holistic approach, seamlessly blending online and offline experiences while embracing local culture and catering to various consumer segments. An omnichannel strategy that considers local context and preferences can lead to greater success in the Chinese market.

Myth 3: Overnight ROI Expectations

Not to rain on your parade, but you must tamp down your expectations to quickly earn fast cash. Many brands think they will make a splash in China and be raking in cash overnight. However, in reality, it is not so fast.

Building real brand love and a thriving business in this market takes time. We are talking patient, sustained effort over the years…not months.

Think about it – you’re starting from zero here with no consumer awareness, distribution, or cultural fluency. That cannot be rushed. So, how do you build your empire from scratch?

Imagine the solid foundation of the castle is from pouring your heart into market research, understanding cultural preferences, and crafting a compelling brand story. Then comes the structure (walls), which support your business in the long haul, such as engaging content, marketing campaigns, and top-notch customer service. As you continue, your structure will be more mature and well-designed by your brand reputation, customer loyalty, and a community that stands by you.

Focus on slowly earning consumer trust and resonance. Localise your offerings, messaging, and style. Find your fans and nurture them. Be in it for the long haul.

Why Commitment is Key

Winning in China means embracing a marathon mindset; it is not only a sprint; it is a long run. Through your commitment to your brand, understanding your audience, and continuously evolving to meet their needs.

Along the way, with sustained brand investment, you are making strides towards a meaningful and lasting impact – perhaps not overnight, but infinitely more meaningful.

Myth 4: In-Person Interviews are the Best

Every move, you are taking all links back to customers, so when you want to gather data from them, which strategy should you use best?

Back in the day, sitting down with Chinese consumers face-to-face was the main research move. But times have changed with the strategy you should use.

Face-to-face has become the old move, and digital has become our new norm. Online communities enable constant back-and-forth with millions of engaged users. Also, web interviews and mobile-friendly surveys allow researchers to connect anytime, anywhere. Platforms such as Alipay even recruit respondents based on purchase behaviours, which is crucial for insights.

Now, research is all about meeting consumers in their digital habitat. From video chat focus groups to rapid survey prototyping, technology unlocks speed and scale. So, embrace the digital realm to plug into the real feelings of Chinese consumers today.

Myth 5: Lost in Translation Troubles

While speaking Chinese definitely helps, it is not everything. It is only the tip of the iceberg. Even if you are fluent, cultural barriers and consumer behaviours can trip you up.

It is about resonating with Chinese culture and consumers. Marketing concepts require a finely tuned local vibe. Take colour symbolism, for example. In Western cultures, white is associated with purity and weddings. However, sometimes, in Chinese culture, we can view it in mourning and funerals.

Depending on your cultural lens, your reaction to seeing someone dressed in white might range from intrigue to distraught.

Similarly, your brand’s messaging around a white-coloured product could be received with enthusiasm or confusion among Chinese consumers, depending on how attuned you are to local colour meanings.

Something funny happened when KFC entered the Chinese market.

KFC is famous for using bold red colour to express its exciting and energetic atmosphere. They used a bright red colour scheme for their restaurant interiors and branding.

However, this confused many Chinese customers since red is associated with luck, happiness, and prosperity in China.

Many Chinese customers initially needed clarification about why a fast food chain would use auspicious red hues. Some even wondered if KFC would bring good fortune or if it was celebrating something special!

Of course, KFC only wanted to leverage the red’s energetic associations back home. They did not intend the prosperity symbolism that red carries in Chinese culture.

This funny mismatch shows how important local colour meanings are. Brands need to research not only direct translations but also cultural interpretations of visual identity elements like colour.

KFC learned fast and adjusted its colour scheme to be less red-dominant. The red is a deeper maroon shade that almost blends into the white text, so the overall effect is more low-key. The last thing they wanted was customers coming in expecting a lucky fortune rather than a bucket of chicken!

Of course, is not only the colour symbolism. The same goes for numbers, symbols, idioms, and more. Certain shapes, mascots, or taglines that delight back home might fall flat or even offend in China.

Navigating these cultural nuances requires empathy, research, and patience. Observe local consumer behaviours and values. Communication in this market goes deeper than words. It is about making emotional connections; there are no shortcuts. Adapting your brand and communications to the local context is key. Let go of textbook grammar and embrace the art of cultural adaptation.

When your messaging resonates on that deeper level, you will unlock true marketing magic in this complex and fascinating market.

Myth 6 : China’s Marketing Is Behind the West

A common misperception is that China’s marketing environment is less advanced than Western markets. However, this overlooks the unique attributes of China’s rapidly evolving consumer landscape.

Chinese tastes might not be as mature as in some Western societies. But China’s Gen Y follows a different path. These young guns, aged 15-35, create completely different lifestyles and consumer flavours at warp speed. Their preferences are shaping new patterns rapidly.

Think digital – China’s youth are mobile-first with high adoption. They did not gradually build up that digital savvy like Westerners.

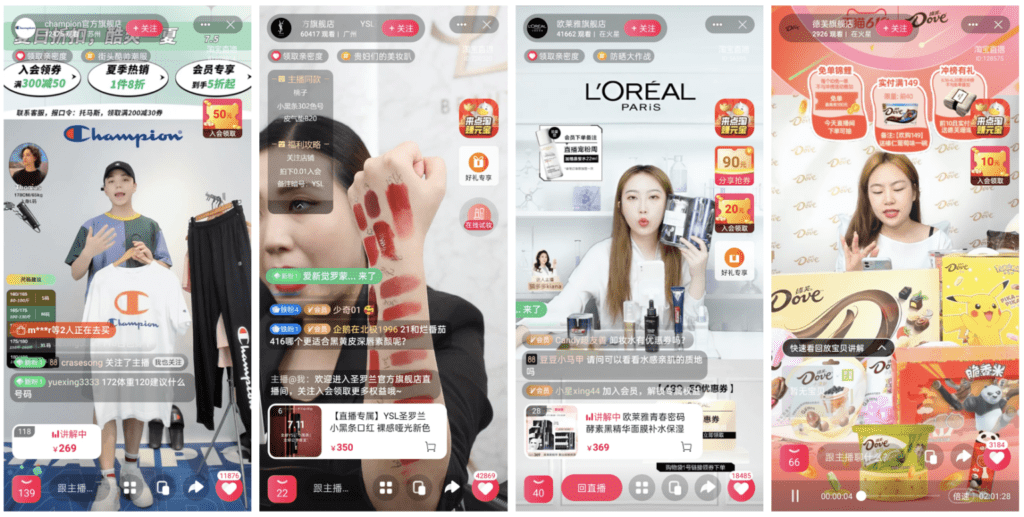

Additionally, China’s passion for shopping as a form of entertainment and self-actualisation has fueled retail innovations like experiential stores and live stream selling. By mid-2018, Douyin(TikTok) live streaming was taking off in China, especially for ecommerce. Viewers could purchase products shown by streamers.

During the start of COVID lockdowns, Douyin live streaming surged in popularity. Stuck at home, millions of Chinese users turned to live streams for entertainment, human interaction, and online shopping.

Individualism AND community, resulting in unique social media behaviours. These dynamics offer opportunities that never existed in Western consumer development.

For marketing, winning here means rolling with constant change. Get in tune with emerging generations on their turf.

China’s marketing scene is not behind – it is a glimpse of the future! Do you want to succeed? Embrace the distinctiveness and own it.

Myth 7: Need to have a Physical Store in China

Compared to ancient times, merchants needed to travel from the Silk Toad to sell goods. However, today’s digital landscape is a different approach already; you could have countless ways to make a splash in China without leaving your country.

So, do not believe you need to be in China to physically unlock the immense business potential. With online content, social media buzz, and collaboration with KOL or local partners, you can tap into business opportunities from anywhere you want.

Take Apple, for example, through crazy digital marketing and partnerships with Chinese e-commerce giants like Alibaba. Apple has captured the hearts of Chinese customers without actually having stores in every city. From Weibo and WeChat, they generate serious product hype to let people get into their products. Moreover, Chinese consumers line up excitedly whenever a new product launches to catch up with the newest trend.

The main point is… you do not need to physically set up a store anymore to activate the Chinese market. Digital status allows you to overcome geographical limitations. With the power of technology and smart local partnerships, you can make your brand succeed in China in no time! From experience, the most important is that before you embark on your journey, you have the right PR strategy upfront to ensure that all major stakeholders are on your side prior to access. This includes the media, potential customers, industry bodies, and local government. All this we can do for you through our AI power technology. We are your future in China. Book a call with us. 😎😎😎

Conclusion

Let’s recap the article. China’s massive consumer base seems like a golden ticket for global brands. But old myths can lead even savvy marketers down the wrong trail. This fast-changing landscape needs a perspective reset.

As we have seen, one-size-fits-all is a no-go in diverse China. You must get granular with consumer research across regions and generations. Blend localised offline presence with digital innovation.

Patience pays off more than chasing quick wins. Go deep on cultural nuances instead of only language skills. Ride China’s unique modern culture to marketing success.

The winning brands are those open to reinventing the playbook, not forcing existing models. Catch the distinct rhythm of Chinese consumers and appreciate their pioneer spirit. They crave brands that truly get them.

By debunking tired myths, we are paving the way to resonate emotionally. This springs from empathy for the culture, not assumptions. China offers endless potential for brands to embrace nuanced human truths.

Moving forward takes openness, not preconceptions. Progress requires diving into how modern Chinese truly live and consume. This exciting journey promises major rewards for brands ready to grow together long-term. The future belongs to those seeking collaboration over quick transactions.

So, as you embark on your adventure into the Chinese market, remember this: It is not only about products, transactions, and sales figures. It is about building bridges, forming bonds, and speaking the language of the heart. As you navigate the choppy waters of myths, armed with the wisdom of truth, let the colours of cultural understanding paint your canvas of success.

So there you have it! Arm yourself with realities that replace myths. Do the work to appreciate China’s one-of-a-kind opportunities. Come correct with cultural fluency. This is your chance to thrive in the world’s biggest consumer arena. Just leave your assumptions at the door.

What are you waiting for? Here is a guide to embark on a journey to build an empire in the Chinese market!