The Top 15 Electric Cars Selling in China: A new Market Research Insight for Entering China’s Market

21 March 2022 | Andy S & Tian Z | 6 min read

Intro

China’s electric car industry is rapidly developing. With the rise of electric vehicles in China and their growing acceptance by society, consumers are now demanding more from these cars than only an alternative fuel source.

By 2021, China has a 61% global market share and 12% penetration of new energy vehicles; nearly 3 million new energy vehicles were sold in China in 2021, representing 14.8% of the total 20.15 million sales.

The top fifteen electric cars selling in China

Competition in China’s electric car market will heat up further this year. The following are the fifteen best-selling electric cars in China for 2021.

| Hongguang Mini (SAIC-GM-Wuling) | Since its launch, Wuling Hongguang MINI has won “The Car of the Year” by its superb price ratio and has overtaken Tesla to take first place in the new energy model sales ranking in 2021. |

| BYD | BYD is a big player in China’s new energy vehicle sector. They originally started as a battery manufacturer and a large multinational group of companies with two industrial clusters: IT and automotive. |

| Tesla | Founded in 2003 and headquartered in California’s Silicon Valley, Tesla is undoubtedly the world’s leading company in new energy vehicles and has led the way in many technologies. The company is a high-tech company that manufactures electric vehicles, develops, and produces clean energy collection and storage products capable of unlimited expansion. Tesla’s popularity in China is gradually expanding. |

| Li | Founded in July 2015, Li Auto is dedicated to creating mid-size SUVs with “no range anxiety” and currently has only one extended-range electric car, the Li ONE, which they launched on May 28, 2021. |

| Chery | Founded in 1997, Chery is a well-known automobile manufacturer, with products covering passenger cars, commercial vehicles, minivans, and new energy vehicles. |

| CHANGAN | CCAG (China Changan Automobile Group) is one of the four major groups of Chinese automobiles. CCAG has exceeded 17 million customers, leading the Chinese brand of automobiles, and has launched a series of classic products such as CS series, Yidong series, and Ruicheng series. |

| GAC Aion | Established in July 2017, GAC Aion focuses on providing mobile and intelligent new energy cars and services and has launched several models such as Aion V and Aion S. |

| ORA | ORA, the new energy brand of Great Wall Motor, has released several models, including ORA R1, ORA Good Cat, and ORA Black Cat. It is popular among female users. |

| Xpeng | Founded in Guangzhou in mid-2014, Xpeng Automotive is a first-tier smart electric car designer, manufacturer, and technology company in China that blends cutting-edge innovations in internet and artificial intelligence. |

| NETA | NETA, one of the newest forces in car manufacturing, was founded in 2014. On May 10, 2021, China’s internet company 360 officially announced that it would join forces with NETA to enter the smart car sector. NETA currently has three models, namely NETA N01, NETA V, and NETA U, which are mainly for young consumers. |

BYD had three models in the top 10, with the BYD Qin outselling all Tesla models at 187,227.

Following the BYD Qin was the Tesla Model Y, which was launched in China last year and jumped to the top of the premium new energy SUV category with 169,853 units sold in 2021. Tesla’s Model 3 followed closely behind, with 150,890 units sold, up almost 10% of that year.

According to the China Association of Automobile Manufacturers, new energy car sales in China accounted for 14.8% of total passenger car sales. This percentage is approaching the government’s target of new energy vehicles accounting for 20% of passenger car sales by 2025.

A market and customer research insight for entering China’s market

China’s new energy vehicle market has seen a surge in sales due to a combination of policy support, market guidance, marketing diversification, and increased user acceptance. Despite the impact of the 2020 epidemic, its sales have risen rather than fallen, which implies that the new energy vehicle market is gradually shifting from policy-driven to market-driven, with market maturity increasing.

User Profile:

The new energy vehicle market is gradually changing from policy-driven to market-driven, with consumers becoming the market leader. In this context, new sellers need to grasp user preferences and understand their user profiles.

For automotive companies, mapping user-profiles and gaining insight into market demand is the focus in today’s data-driven trend. In the future, accurately grasping user preferences and needs to achieve operations has become vital to stand out in the market competition.

Your targeted users should be the middle and high-income groups interested in new things and technologies. These groups are high potential consumers of electric vehicles.

Age and geographical distribution

According to New Energy Vehicle Crowd Survey 2021, it is clear that owners between eighteen and forty are the main groups in the current vehicle market, and they are from the new first-tier cities who pursue a higher quality of life.

Main channels for information

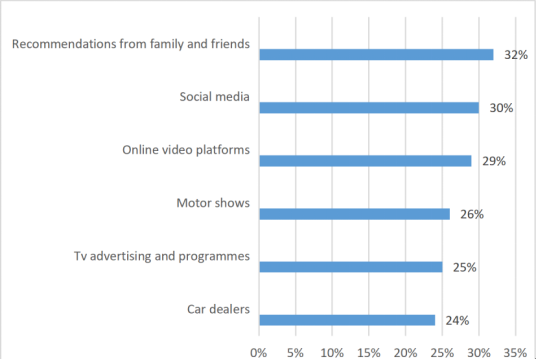

Of all the passive channels of information reception, reviews from friends and family are in the mainstream, and the automotive vertical online media are replacing them as the most important source of information. The importance of digital channels is already increasing yearly.

In short, electric car consumers are relying more on social media. Online channels account for three of the four channels with the greatest impact on electric car owners.

Digital technology and the rise of new media are replacing traditional brand marketing methods such as advertising and newspapers. Consumers are moving from superficial awareness of brands to a deeper identification with their interests.

APP preference

Top 10 apps used by target groups:

Top ten car-related Apps used by target people

Reading content preferences

An analysis of data such as the labels given to users by app developers and users’ app installation lists revealed that more than half of the target users were interested in news and leisure books.

Nearly 50% of users read car-related content, including car information, learning about traffic regulations, and car maintenance. In addition, fitness and travel are also topics of interest to this group.

Do you want more insight for your target audience as the following? Enlybee can help!

1. Age range for your target audience

2. Where can you find them – locality (cities/region where most of them are)

3. Top 5 interests for the target audience – e.g. new technologies, life hacks, personal wellness

4. Top 5 sources they trust – e.g. KOL, Customer reviews, statistics, word of mouth

5. Top 5 channels they read and watch contents – e.g. Online news, stream movies, information portals, user-generated content, social media channels

6. Top five digital information portals or platforms they use – e.g. theverge.com, cnet.com

Online news, streaming movies, information portals, etc.

Conclusion

In the era of the internet, new changes are taking place in consumer behavior, demographics, preferences for automotive content, and car purchasing needs. In the face of the complex market situation, the only way to grasp the opportunities is to understand the trends.

How to adapt to consumers’ behavior and preferences, and how to develop consumers’ brand awareness are issues that new energy vehicle companies need to consider. If you are interested in entering China’s electric car market but do not know where to start or desire help with your venture, feel free to contact us.